What I’m Drinking as I Write – Decaf Coffee

- 1 cup of decaf coffee

- Brew and contemplate the lack of stimulation

For the last several years, I have often had friends ask me for investing advice. There are many ways I could answer their questions – but I think sticking to the basics works well here. Sometimes investing in the stock market seems overwhelming or convoluted. Sometimes it might seem like it’s even a form of gambling. Trust me – it can be, and it shouldn’t be.

First things first, unless you hire a financial advisor or spend time learning the art of investing – let’s not make things more difficult than they need to be. We will pick a few ETFs or mutual funds to look into and narrow our choice(s) from there. If there is a stock you feel strongly about, by all means incorporate it into your investments, otherwise sticking to funds will work just fine.

When people discuss “the market” or “the stock market”, they are likely referring to the S&P 500 – an index that tracks the 500 largest publicly traded companies in the U.S. So – what does that mean to us? Think of companies like Amazon, Google, Tesla, or Nike – and let’s pretend each of these companies is an egg. Now, think about putting 500 of those eggs (500 companies) into a basket. We can think of this basket as an ETF (exchange-traded fund) that tracks the S&P 500. When we purchase an ETF, we instantly gain exposure to each of those 500 companies, giving us immediate diversification and without the hassle of purchasing 500 different stocks separately.

Why does this matter? One thing about investing that has always resonated with me is that practically everything around us is related to the stock market. Take a look around you – do you drive a Honda Accord? (Put simply), the more Honda Accords (or cars in general) that Honda sells, the more money it makes, and the more its stock is likely to go up. Do you purchase groceries at Kroger? The more groceries Kroger can sell to customers at higher prices combined with lower costs, the more its stock is likely to increase. We can benefit from the opportunities we are surrounded with in our daily lives, but no one else is going to do it for us.

Now that we have an ETF picked out, let’s discuss what I might argue is the most crucial part of investing – starting. And continuing. It’s important that we not only choose to invest today, but set our future selves up the best we can by choosing to invest often. When setting up your investment account (whether on your own or with the help of an advisor), turn on automatic contributions. What this means is every month (week, twice a month, etc.) a certain dollar amount ($10, $100, etc.) will be automatically deposited into your investment account (from your bank account). Once this money is in your account, you can invest it into the fund(s) you originally chose when creating your account. This will help you in so many ways. Firstly, it takes your busy life into consideration: you don’t need to think about it. Secondly, it takes your emotions out of it: “Is the market up today? I shouldn’t add more money if the market isn’t doing well lately.” It won’t matter in 40 years what the market did today. Lastly (in some, not all, situations): after a while, you likely won’t even notice that money is missing from your bank account.

When it comes to investing, there are four main factors that play a role in how much money you could potentially have in the future.

- How much you have today (let’s call this the Present Value factor, or PV for short)

- How much you will contribute each year (let’s call this the Payment factor or PMT for short)

- How many years you will be saving/investing (let’s call this N for the Number of Periods)

- How much you expect to earn by investing each year (after management fees, expense ratios, etc. – we will call this the Interest Rate or I/Y)

For clarification, I am using years for the explanation and example to follow, but the period frequency could be anything (months, days, etc.).

Of all these factors, which do you think plays the largest role in how much money you could have in the future (let’s call this our Future Value factor, or FV)?

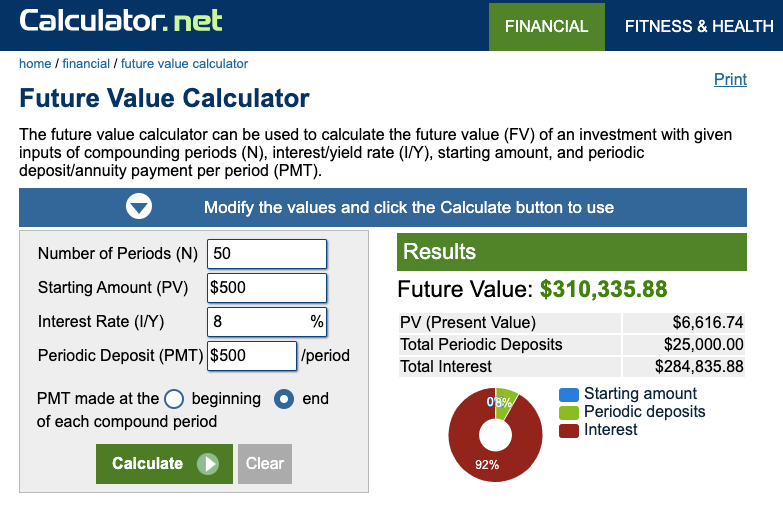

Let’s say you have $500 right now that you don’t need. You can also contribute $500 into your account every year, for the next 50 years until you expect to retire. Additionally, you are going to put your money in an S&P 500 Index fund, which might average 8% annually. Here’s what that might look like in 50 years:

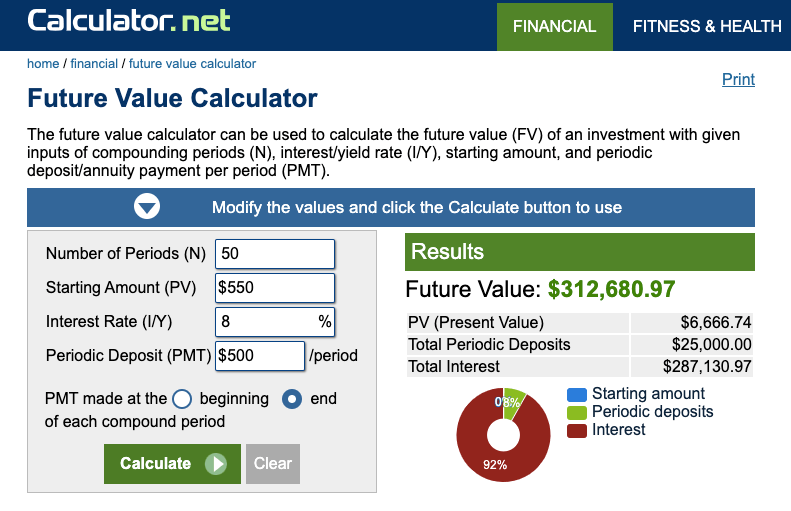

Now let’s change each of the four factors by a 10% increment, one at a time. Keeping everything else the same, let’s see what would happen if you had $550 right now to invest:

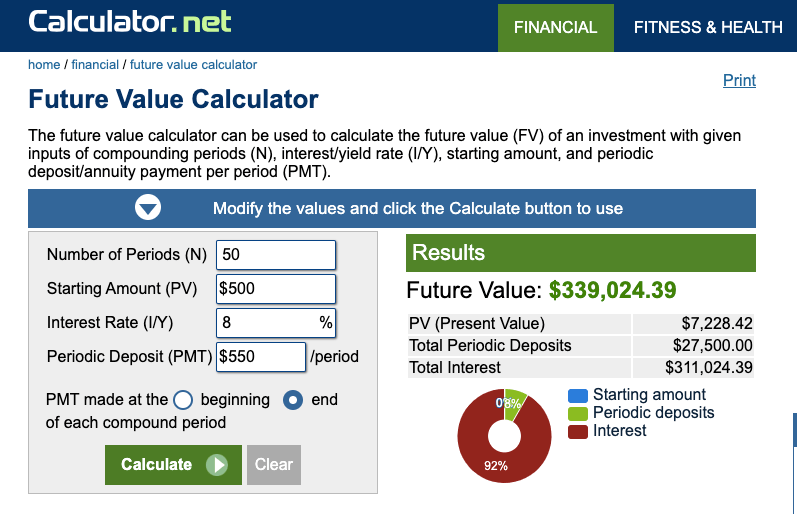

Not bad – after investing that extra $50 today, we might have an extra $2,400 in the future. Now let’s see what would happen if we only changed our contribution amount – and instead of $500 a year, we can deposit $550 each year:

Depositing just an extra $50 every year might allow us to have $28,700 more in the future. Now let’s see what happens if we go back to investing $500 right now (and keeping everything else the same) but think we could earn 8.8% on our investments annually.

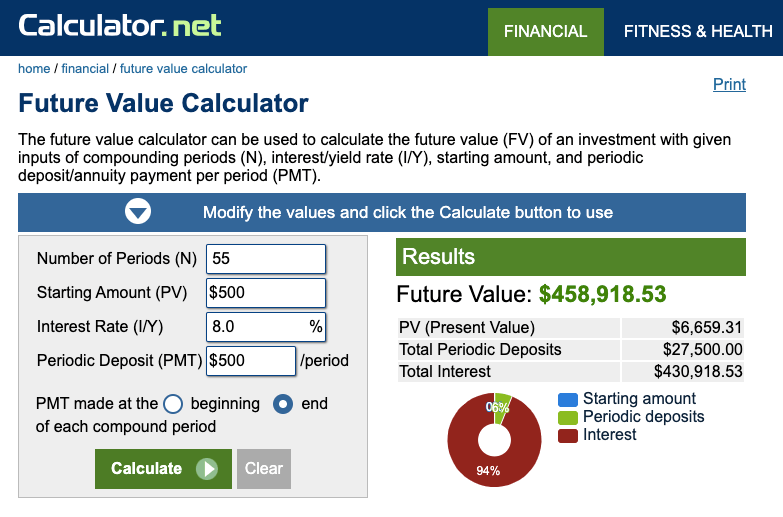

Woah! Increasing how much we think we can earn in the market by 0.8% each year might allow us to have an extra $103,000 in the future! Okay, last one, and this is my favorite. Putting everything back to the normal scenario, let’s say we can keep our money invested for 55 years – instead of the original 50. That extra 5 years won’t change much, will it?

Being invested those extra five years increased our future value by nearly $150,000(!!!) – the biggest increase by far among the four main factors.

So, what all does this tell us? Time is the most important factor when it comes to your earnings potential in the stock market. Wait until we are 75 to retire instead of age 70? Nope! It means start now. Start right now. It doesn’t matter if you only have $20, and it doesn’t matter if you can only deposit an extra $5 into your account every month. What matters is you start now, you keep adding whenever and whatever you can (only what you don’t need for daily necessities and emergencies!), and you keep it invested. Reach out to someone you know or an advisor to help you get started. Watch a few videos on YouTube or read a few articles online. You don’t need $100,000 to open an investment account, and you don’t need to spend 20 hours researching what stocks to purchase – you can start with as little as $5 and invest in an ETF or mutual fund. Start now.

Lesson:

I’m not sure what I was waiting for. I didn’t open my first investment account and place my first trade until I was 22 and working a full-time job. Before that, my brother had set up a Roth IRA and a 529 account for me, but I never directly created the accounts or chose investments in them. I had plenty of cash outside of my monthly living expenses, I majored in Financial Services, I read book after book on everything finance and investing, and yet there was something holding me back. Maybe I was afraid I would make a mistake, or that it would be much more complicated than I could handle. Maybe I was afraid of asking for help because (to me) people assumed I knew what I was doing. The point is, I missed out on vital years of participating in the stock market. I don’t regret doing this, but I sure have learned from it. So please, take a personal lesson from me, and start now, with whatever excess money you can “afford” to invest.

“What saves a man is to take a step. Then another step. It is always the same step, but you have to take it.”

Antoine De Saint-Exupéry, Wind, Sand, and Stars

Happy Sipping!

- E

Great insight that I will use for not only myself, but my kids as well!

LikeLiked by 1 person